Execution

Copy

SECURITIES

PURCHASE AGREEMENT

THIS

SECURITIES PURCHASE AGREEMENT (“Agreement”)

is

made as of this 12th day of April, 2007 (the “Signing

Date”)

by and

among Novelos Therapeutics, Inc., a Delaware corporation (the “Company”),

Xmark

Opportunity Fund, L.P., a Delaware limited partnership (“Xmark

LP”),

Xmark

Opportunity Fund, Ltd., a Cayman Islands exempted company (“Xmark

Ltd”),

Xmark

JV Investment Partners LLC, a Delaware limited liability company (“Xmark

LLC”

and

together with Xmark LP and Xmark Ltd, the “Xmark

Entities”),

Caduceus Master Fund Limited, a Bermuda corporation (“Caduceus

Master”),

Caduceus Capital II, L.P., a Delaware limited partnership (“Caduceus

Capital”),

UBS

Eucalyptus Fund, L.L.C., a Delaware registered investment company (“UBS

Eucalyptus”),

PW

Eucalyptus Fund, Ltd., a Cayman Islands investment company (“PW

Eucalyptus”)

and

HFR SHC Aggressive Master Trust, a Bermuda trust (“HFR”

and

together with Caduceus Master, Caduceus Capital, UBS Eucalyptus, PW Eucalyptus,

the “OrbiMed

Entities”,

and

the OrbiMed Entities and the Xmark Entities together, the “Lead

Investors”),

and

the other investors set forth on Schedule

I affixed

hereto, as such Schedule may be amended from time to time in accordance with

the

terms of this Agreement (each an “Investor”

and

collectively the “Investors”;

for

the avoidance of doubt, the Lead Investors are each an Investor).

Recitals:

A. The

Company desires, pursuant to this Agreement, to raise up to the Investment

Amount (as defined below) through the issuance and sale of the following to

the

Investors (the “Private

Placement”):

(i)

up to 1,500 shares of a newly created series of the Company’s Preferred Stock,

designated “Series B Convertible Preferred Stock”, par value $0.00001 per share

(the “Preferred

Stock”),

which

Preferred Stock shall have the rights, preferences and privileges set forth

in

the Certificate of Designations, Preferences and Rights, in the form of

Exhibit

A

annexed

hereto and made a part hereof (the “Certificate

of Designations”),

and

each share of Preferred Stock shall have a stated value of $10,000.00 and shall

initially be convertible into shares of the Company's Common Stock, par value

$0.00001 per share (the “Common

Stock”),

at a

price of $1.00 per share (the “Conversion

Price”),

for

an aggregate of 15,000,000 shares of Common Stock; and (ii) warrants to acquire

up to 7,500,000 shares of Common Stock, equal to 50% of the number of shares

of

Common Stock underlying the Preferred Stock on the date of issue, at an exercise

price of $1.25 per share, in the form of Exhibit

B

annexed

hereto and made a part hereof (the “Warrants”);

B. The

Investors desire to purchase from the Company, and the Company desires to issue

and sell to the Investors, upon the terms and conditions stated in this

Agreement, such number of shares of Preferred Stock and Warrants to purchase

such number of shares of Common Stock as is set forth next to each such

Investor’s name on Schedule

I

affixed

hereto;

C. Subject

to the conditions hereinafter set forth, on the date hereof, the Investors

will

purchase $15,000,000 of the Preferred Stock and Warrants in the Private

Placement (the “Closing”);

D. The

Company has engaged Rodman & Renshaw, LLC as its placement agent (the

“Placement

Agent”)

for

the Private Placement on a “best efforts” basis;

E. Contemporaneous

with the sale of the Preferred Stock and the Warrants at the Closing, the

parties hereto will enter into a Registration Rights Agreement, in the form

attached hereto as Exhibit

C

(the

“Registration

Rights Agreement”),

pursuant to which, among other things, the Company will provide certain

registration rights to the Investors with respect to the Private Placement

under

the Securities Act of 1933 (as amended, the “1933

Act”)

and

the rules and regulations promulgated thereunder, and applicable state

securities laws; and

F. The

Company and the Investors are executing and delivering this Agreement in

reliance upon the exemption from securities registration afforded by the

provisions of Regulation D (“Regulation

D”),

as

promulgated by the U.S. Securities and Exchange Commission (the “SEC”)

under

the 1933 Act and Regulation S (“Regulation

S”),

as

promulgated by the SEC under the 1933 Act.

NOW,

THEREFORE,

in

consideration of the mutual promises made herein and for other good and valuable

consideration, the receipt and sufficiency of which is hereby acknowledged,

the

parties hereto agree as follows:

1. Definitions.

In

addition to those terms defined above and elsewhere in this Agreement, for

the

purposes of this Agreement, the following terms shall have the meanings set

forth in this Section

1:

“1933

Act”

has

the

meaning set forth in the Recitals.

“1934

Act”

means

the Securities Exchange Act of 1934, as amended, and the rules and regulations

promulgated thereunder.

“10-KSB”

has

the

meaning set forth in Section

5.6.

“Affiliate”

means,

with respect to any Person, any other Person which directly or indirectly

Controls, is Controlled by, or is under common Control with, such

Person.

“Agreement”

has

the

meaning set forth in the Recitals.

“Alternative

Transaction”

has

the

meaning set forth in Section

8.10.

“Business

Day”

means

a

day, other than a Saturday or Sunday, on which banks in New York City are open

for the general transaction of business.

“Buy-In

Price”

has

the

meaning set forth in Section

8.15.

“Certificate

of Designations”

has

the

meaning set forth in the Recitals.

“Company

Counsel Opinion”

means

a

legal opinion from the Company Counsel, dated as of the applicable Closing

Date,

in the form attached hereto as Exhibit

D.

“Closing”

has

the

meaning set forth in Section

4.

“Closing

Date”

means,

as applicable, the first Closing Date and/or any subsequent Closing

Dates.

“Common

Stock”

has

the

meaning set forth in the Recitals, and also includes any securities into which

the Common Stock may be reclassified.

“Company”

has

the

meaning set forth in the Recitals.

“Company

Counsel”

means

Foley Hoag LLP, counsel to the Company

“Company’s

Knowledge”

means

the actual knowledge of the officers of the Company, after due inquiry and

investigation.

“Confidential

Information”

means

trade secrets, confidential information and know-how (including but not limited

to ideas, formulae, compositions, processes, procedures and techniques, research

and development information, computer program code, performance specifications,

support documentation, drawings, specifications, designs, business and marketing

plans, and customer and supplier lists and related information).

“Control”

means

the possession, direct or indirect, of the power to direct or cause the

direction of the management and policies of a Person, whether through the

ownership of voting securities, by contract or otherwise.

“Conversion

Price”

has

the

meaning set forth in the Recitals.

“Conversion

Shares”

means

the shares of Common Stock issuable upon conversion of the Preferred

Stock.

“Covenant

Expiration Event”

has

the

meaning set forth in Section

8.8.

“Deadline

Date”

has

the

meaning set forth in Section

8.15.

“Disclosure

Schedules”

has

the

meaning set forth in Section

5.

“Eligible

Market”

means

the Trading Market on which the Common Stock is primarily listed on and quoted

for trading, which, as of the Closing Date means the OTC Bulletin Board

(“OTCBB”).

“Environmental

Laws”

has

the

meaning set forth in Section

5.15.

“Escrow

Amount”

has

the

meaning set forth in Section

3.1(a).

“Escrow

Termination Date”

means

the 15th calendar day after the Signing Date; provided,

however,

the

Lead Investors and the Company may jointly agree to extend the Escrow

Termination Date for up to two additional 15-day periods by giving written

notice to the Lead Investor Counsel of their election to so extend the Escrow

Termination Date, in each case for up to an additional 15 calendar days, and

in

each such case, the Escrow Termination Date shall be the date specified in

such

notice; provided,

further,

however,

the

Escrow Termination Date shall not be later than May 25 2007, on which date,

if

the Closing has not occurred, Lead Investor Counsel shall return the Escrow

Amount in accordance with Section

3.1(b);

provided,

further,

however,

the

Escrow Termination Date shall occur upon termination of this Agreement pursuant

to Section

8.13.

“Indemnified

Person”

has

the

meaning set forth in Section

9.3.

“Intellectual

Property”

means

all of the following: (i) patents, patent applications, patent disclosures

and

inventions (whether or not patentable and whether or not reduced to practice);

(ii) trademarks, service marks, trade dress, trade names, corporate names,

logos, slogans and Internet domain names, together with all goodwill associated

with each of the foregoing; (iii) copyrights and copyrightable works; (iv)

registrations, applications and renewals for any of the foregoing; (v) trade

secrets, Confidential Information and know-how (including, but not limited

to,

ideas, formulae, compositions, manufacturing and production processes and

techniques, research and development information, drawings, specifications,

designs, business and marketing plans, and customer and supplier lists and

related information); and (vi) computer software (including, but not limited

to,

data, data bases and documentation).

“Investment

Amount”

means

an amount equal to $15,000,000.

“Investor(s)”

has

the

meaning set forth in the Recitals.

“Lead

Investors”

has

the

meaning set forth in the Recitals.

“Lead

Investor Counsel”

has

the

meaning set forth in Section

3.1(a).

“Lead

Investor Counsel Duties”

has

the

meaning set forth in Section

3.2(a).

“Lead

Investor Counsel Fees”

has

the

meaning set forth in Section

10.5.

“Lead

Investor Director”

has

the

meaning set forth in Section

8.7(a).

“Lead

Investor Observer”

has

the

meaning set forth in Section

8.7(b).

“License

Agreements”

has

the

meaning set forth in Section

5.14(b).

“Losses”

has

the

meaning set forth in Section

9.2.

“Material

Adverse Effect”

means

a

material adverse effect on (i) the assets and liabilities, prospects, results

of

operations, condition (financial or otherwise) or business of the Company and

its Subsidiaries taken as a whole, or (ii) the ability of the Company to issue

and sell the Securities and to perform its obligations under the Transaction

Documents; provided,

however,

that:

(A) any adverse effect that results from general economic, business or industry

conditions, the taking by the Company of any action permitted or required by

the

Agreement, or the announcement or pendency of transactions contemplated

hereunder, shall not, in and of itself, constitute a "Material Adverse Effect"

on the Company, and shall not be considered in determining whether there has

been or would be a "Material Adverse Effect" on the Company and (B) a decline

in

the Company's stock price shall not, in and of itself, constitute a "Material

Adverse Effect" on the Company and shall not be considered in determining

whether there has been or would be a "Material Adverse Effect" on the Company.

“Material

Contract”

means

any contract of the Company or any Subsidiary (i) that was required to be filed

as an exhibit to the SEC Filings pursuant to Item 601(b)(4) or Item 601(b)(10)

of Regulation S-B of the 1933 Act or (ii) the loss of which could reasonably

be

expected to have a Material Adverse Effect.

“OrbiMed

Entities”

has

the

meaning set forth in the Recitals.

“Person”

means

an individual, corporation, partnership, limited liability company, trust,

business trust, association, joint stock company, joint venture, sole

proprietorship, unincorporated organization, governmental authority or any

other

form of entity not specifically listed herein.

“Placement

Agent”

has

the

meaning set forth in the Recitals.

“Placement

Agent Agreement”

means

that certain letter from the Company to the Placement Agent, dated February

12,

2007.

“Placement

Agent Fee”

has

the

meaning set forth in Section

5.19.

“Preferred

Stock”

has

the

meaning set forth in the Recitals.

“Press

Release”

has

the

meaning set forth in Section

8.13.

“Private

Placement”

has

the

meaning set forth in the Recitals.

“Registration

Rights Agreement”

has

the

meaning set forth in the Recitals.

“Regulation

D”

has

the

meaning set forth in the Recitals.

“Requisite

Holders”

shall

mean the holders of at least a majority of the then outstanding shares of

Preferred Stock which majority must include (i) the Xmark Entities, provided

such Xmark Entities have purchased an aggregate of $4,000,000 of Preferred

Stock

pursuant to this Agreement and hold at least one-third of the Preferred Stock

issued to the Xmark Entities at Closing as of the date of determination and

(ii)

the OrbiMed Entities, provided such OrbiMed Entities have purchased an aggregate

of $5,000,000 of Preferred Stock pursuant to this Agreement and hold at least

one-third of the Preferred Stock issued to the OrbiMed Entities at Closing

as of

the date of determination (appropriately adjusted for any stock dividend, stock

split, reverse stock split, reclassification, stock combination or other

recapitalization occurring after the date hereof).

“Rule

144”

has

the

meaning set forth in Section

8.14.

“SEC”

has

the

meaning set forth in the Recitals.

“SEC

Filings”

has

the

meaning set forth in Section

5.6.

“Securities”

means

the Preferred Stock, the Conversion Shares, the shares of Common Stock issuable

as payment-in-kind dividends on the Preferred Stock in accordance with the

terms

thereof, the Warrants and the Warrant Shares.

“Signing

Date”

has

the

meaning set forth in the Recitals.

“Subsidiary”

has

the

meaning set forth in Section

5.1.

“Transaction

Documents”

means

this Agreement, the Warrants and the Registration Rights Agreement.

“Warrant

Shares”

means

the shares of Common Stock issuable upon exercise of the Warrants.

“Warrants”

has

the

meaning set forth in the Recitals.

“Xmark

Entities”

has

the

meaning set forth in the Recitals.

2. Purchase

and Sale of Securities.

2.1. Closing.

Subject

to the terms and conditions of this Agreement, including without limitation,

the

conditions set forth in Section

7,

there

shall be a closing at which the Company shall issue and sell, and each Investor

listed on Schedule

I

attached

hereto, which Schedule

I

may be

amended from time to time, with the prior written consent of the Lead Investors,

to add additional Investors who agree to purchase Preferred Stock in the Private

Placement by executing a counterpart to this Agreement following the date

hereof, shall severally, and not jointly, purchase, the number of shares of

Preferred Stock and the number of Warrants, in each case, in the respective

amounts set forth opposite their names on Schedule

I

affixed

hereto, in exchange for the cash consideration set forth as the “Closing

Purchase Price” opposite their respective names on Schedule

I

affixed

hereto.

3. Escrow.

3.1. (a)

Simultaneously with the execution and delivery of this Agreement by an Investor,

such Investor shall promptly cause a wire transfer of immediately available

funds (U.S. dollars) in an amount representing the “Aggregate Purchase Price” on

such Investor’s signature page affixed hereto and opposite such Investor’s name

thereon, to be paid to a non-interest bearing escrow account of Lowenstein

Sandler PC, the Lead Investors’ counsel (“Lead

Investor Counsel”),

set

forth on Schedule

II

affixed

hereto (the aggregate amounts received being held in escrow by Lead Investor

Counsel are referred to herein as the “Escrow

Amount”).

Lead

Investor Counsel shall hold the Escrow Amount in escrow in accordance with

Section

3.1(b).

(b) The

Lead

Investor Counsel shall continue to hold the Escrow Amount in escrow in

accordance with and subject to this Agreement, from the date of its receipt

of

the funds constituting the Escrow Amount until the soonest of:

(i)

the

Escrow Termination Date,

in

which case, if Lead Investor Counsel then holds any portion of the Escrow

Amount, then: (A) Lead Investor Counsel shall return the portion of the Escrow

Amount received from each Investor which it then holds, to each such Investor,

in accordance with written wire transfer instructions received from such

Investor; and (B) if Lead Investor Counsel has not received written wire

transfer instructions from any Investor before the 30th

day

after the Escrow Termination Date, then Lead Investor Counsel may, in its sole

and absolute discretion, either (x) deposit that portion of the Escrow Amount

to

be returned to such Investor in a court of competent jurisdiction on written

notice to such Investor, and Lead Investor Counsel shall thereafter have no

further liability with respect to such deposited funds, or (y) continue to

hold

such portion of the Escrow Amount pending receipt of written wire transfer

instructions from such Investor or an order from a court of competent

jurisdiction; OR

(ii)

in

the

case of the Closing,

receipt

of written instructions from the Lead Investors that the Closing shall have

been

consummated, in which case, Lead Investor Counsel shall release the Escrow

Amount constituting the aggregate “Closing Purchase Price” as follows: (A) the

cash portion of the Placement Agent Fee applicable to the Placement Agent,

(B)

the Lead Investor Counsel Fees to the Lead Investor Counsel, and (C) the balance

of the aggregate “Closing Purchase Price” to the Company.

3.2. The

Company and the Investors acknowledge and agree for the benefit of Lead Investor

Counsel (which shall be deemed to be a third party beneficiary of this

Section

3 and

of

Section

10)

as

follows:

(a) Lead

Investor Counsel: (i) is not responsible for the performance by the Company,

the

Investors or Placement Agent of this Agreement or any of the Transaction

Documents or for determining or compelling compliance therewith; (ii) is only

responsible for (A) holding the Escrow Amount in escrow pending receipt of

written instructions from the Lead Investors directing the release of the Escrow

Amount, and (B) disbursing the Escrow Amount in accordance with the written

instructions from the Lead Investors, each of the responsibilities of Lead

Investor Counsel in clause (A) and (B) is ministerial in nature, and no implied

duties or obligations of any kind shall be read into this Agreement against

or

on the part of Lead Investor Counsel (collectively, the “Lead

Investor Counsel Duties”);

(iii)

shall not be obligated to take any legal or other action hereunder which might

in its judgment involve or cause it to incur any expense or liability unless

it

shall have been furnished with indemnification acceptable to it, in its sole

discretion; (iv) may rely on and shall be protected in acting or refraining

from

acting upon any written notice, instruction (including, without limitation,

wire

transfer instructions, whether incorporated herein or provided in a separate

written instruction), instrument, statement, certificate, request or other

document furnished to it hereunder and believed by it to be genuine and to

have

been signed or presented by the proper Person, and shall have no responsibility

for making inquiry as to, or for determining, the genuineness, accuracy or

validity thereof, or of the authority of the Person signing or presenting the

same; (v) may consult counsel satisfactory to it, and the opinion or advice

of

such counsel in any instance shall be full and complete authorization and

protection in respect of any action taken, suffered or omitted by it hereunder

in good faith and in accordance with the opinion or advice of such counsel;

and

(vi) shall be authorized to receive from the Escrow Amount, on the applicable

Closing Date, the Lead Investor Counsel Fees. Documents and written materials

referred to in this Section

3.2(a)

include,

without limitation, e-mail and other electronic transmissions capable of being

printed, whether or not they are in fact printed; and any such e-mail or other

electronic transmission may be deemed and treated by Lead Investor Counsel

as

having been signed or presented by a Person if it bears, as sender, the Person’s

e-mail address.

(b) Lead

Investor Counsel shall not be liable to anyone for any action taken or omitted

to be taken by it hereunder, except in the case of Lead Investor Counsel’s gross

negligence or willful misconduct in breach of the Lead Investor Counsel Duties.

IN NO EVENT SHALL LEAD INVESTOR COUNSEL BE LIABLE FOR INDIRECT, PUNITIVE,

SPECIAL OR CONSEQUENTIAL DAMAGE OR LOSS (INCLUDING BUT NOT LIMITED TO LOST

PROFITS) WHATSOEVER, EVEN IF LEAD INVESTOR COUNSEL HAS BEEN INFORMED OF THE

LIKELIHOOD OF SUCH LOSS OR DAMAGE AND REGARDLESS OF THE FORM OF ACTION.

(c) The

Company and the Investors hereby indemnify and hold harmless Lead Investor

Counsel from and against any and all loss, liability, cost, damage and expense,

including, without limitation, reasonable counsel fees and expenses, which

Lead

Investor Counsel may suffer or incur by reason of any action, claim or

proceeding brought against Lead Investor Counsel arising out of or relating

to

the performance of the Lead Investor Counsel Duties, unless such action, claim

or proceeding is exclusively the result of the willful misconduct, bad faith

or

gross negligence of Lead Investor Counsel.

(d) Lead

Investor Counsel has acted as legal counsel to one or more of the Investors

in

connection with this Agreement and the other Transaction Documents, is merely

acting as a stakeholder under this Agreement and is, therefore, hereby

authorized to continue acting as legal counsel to such Lead Investors including,

without limitation, with regard to any dispute arising out of this Agreement,

the other Transaction Documents, the Escrow Amount or any other matter. Each

of

the Company and the Investors hereby expressly consents to permit Lead Investor

Counsel to represent such Investors in connection with all matters relating

to

this Agreement, including, without limitation, with regard to any dispute

arising out of this Agreement, the other Transaction Documents, the Escrow

Amount or any other matter, and hereby waives any conflict of interest or

appearance of conflict or impropriety with respect to such representation.

Each

of the Company and the Investors has consulted with its own counsel specifically

about this Section

3

to the

extent they deemed necessary, and has entered into this Agreement after being

satisfied with such advice.

(e) Lead

Investor Counsel shall have the right at any time to resign for any reason

and

be discharged of its duties as escrow agent hereunder (including without

limitation the Lead Investor Counsel Duties) by giving written notice of its

resignation to the Company and the Lead Investors at least ten (10) calendar

days prior to the specified effective date of such resignation. All obligations

of the Lead Investor Counsel hereunder shall cease and terminate on the

effective date of its resignation and its sole responsibility thereafter shall

be to hold the Escrow Amount, for a period of ten (10) calendar days following

the effective date of resignation, at which time,

(i) Lead

Investor Counsel shall be entitled to receive from the Escrow Amount the Lead

Investor Counsel Fees through and including the effective date of resignation;

and

(ii) if

a

successor escrow agent shall have been appointed and have accepted such

appointment in a writing to both the Company and the Lead Investors, then upon

written notice thereof given to each of the Investors, the Lead Investor Counsel

shall deliver the Escrow Amount to the successor escrow agent, and upon such

delivery, Lead Investor Counsel shall have no further liability or obligation;

or

(iii) if

a

successor escrow agent shall not have been appointed, for any reason whatsoever,

Lead Investor Counsel shall at its option in its sole discretion, either (A)

deliver the Escrow Amount to a court of competent jurisdiction selected by

Lead

Investor Counsel and give written notice thereof to the Company and the

Investors, or (B) continue to hold Escrow Amount in escrow pending written

direction from the Company and the Lead Investors in form and formality

satisfactory to Lead Investor Counsel.

(f) In

the

event that the Lead Investor Counsel shall be uncertain as to its duties or

rights hereunder or shall receive instructions with respect to the Escrow Amount

or any portion thereunder which, in its sole discretion, are in conflict either

with other instructions received by it or with any provision of this Agreement,

Lead Investor Counsel shall have the absolute right to suspend all further

performance under this Agreement (except for the safekeeping of such Escrow

Amount) until such uncertainty or conflicting instructions have been resolved

to

the Lead Investor Counsel’s sole satisfaction by final judgment of a court of

competent jurisdiction, joint written instructions from the Company and all

of

the Investors, or otherwise. In the event that any controversy arises between

the Company and one or more of the Investors or any other party with respect

to

this Agreement or the Escrow Amount, the Lead Investor Counsel shall not be

required to determine the proper resolution of such controversy or the proper

disposition of the Escrow Amount, and shall have the absolute right, in its

sole

discretion, to deposit the Escrow Amount with the clerk of a court selected

by

the Lead Investor Counsel and file a suit in interpleader in that court and

obtain an order from that court requiring all parties involved to litigate

in

that court their respective claims arising out of or in connection with the

Escrow Amount. Upon the deposit by the Lead Investor Counsel of the Escrow

Amount with the clerk of such court in accordance with this provision, the

Lead

Investor Counsel shall thereupon be relieved of all further obligations and

released from all liability hereunder.

(g) The

provisions of this Section

3

shall

survive any termination of this Agreement.

4. Closings.

4.1

Place.

The

closings of the transactions contemplated by this Agreement (the “Closing”)

shall

take place at the offices of Lead Investor Counsel, 1251 Avenue of the Americas,

New York, New York, or at such other location and on such other date as the

Company and the Lead Investors shall mutually agree, on the Closing

Date.

4.2 Closing.

Upon

satisfaction of the conditions to Closing set forth in Section

7

hereof,

the Lead Investors shall instruct Lead Investor Counsel to immediately release,

and upon receipt of such instructions, Lead Investor Counsel shall release,

that

portion of the Escrow Amount constituting the aggregate “Closing Purchase Price”

as follows: (A) the portion of the Cash Placement Agent Fee applicable to the

Placement Agent, (B) the Lead Investor Counsel Fees to the Lead Investor

Counsel, and (C) the balance of the aggregate “Closing Purchase Price” to the

Company (the date of receipt of such balance by the Company is hereinafter

referred to as the “Closing

Date”).

On

the Closing Date, the Company shall issue or cause to be issued to each Investor

a certificate or certificates, registered in such name or names as each such

Investor may designate, representing the number of shares of Preferred

Stock as

is set

forth opposite such Investor’s name on Schedule

I

affixed

hereto and shall also issue to each such Investor, or such Investor’s respective

designees, the number of Warrants as is set forth opposite such Investor’s name

on Schedule I

affixed

hereto.

5. Representations

and Warranties of the Company.

The

Company hereby represents and warrants to the Investors on and as of the Signing

Date and on the Closing Date, knowing and intending their reliance hereon,

that,

except as set forth in the schedules delivered on the Signing Date

(collectively, the “Disclosure

Schedules”):

5.1. Organization,

Good Standing and Qualification.

Each of

the Company and its Subsidiaries, a complete list of which is set forth in

Schedule

5.1

hereto

(“Subsidiaries”),

is a

corporation duly incorporated, validly existing and in good standing under

the

laws of the jurisdiction of its incorporation and has all requisite corporate

power and authority to carry on its business as now conducted and to own its

properties. Each of the Company and its Subsidiaries is duly qualified to do

business as a foreign corporation and is in good standing in each jurisdiction

in which the conduct of its business or its ownership or its leasing of property

makes such qualification or licensing necessary, unless the failure to so

qualify would not have a Material Adverse Effect.

5.2. Authorization.

The

Company has full power and authority and has taken all requisite action on

the

part of the Company, its officers, directors and stockholders necessary for

(i)

the authorization, execution and delivery of the Transaction Documents and

the

Certificate of Designations, (ii) authorization of the performance of all

obligations of the Company hereunder or thereunder, and (iii) the authorization,

issuance (or reservation for issuance) and delivery of the

Securities.

The

Transaction Documents constitute the legal, valid and binding obligations of

the

Company, enforceable against the Company in accordance with their respective

terms, subject to bankruptcy, insolvency, fraudulent transfer, reorganization,

moratorium and similar laws of general applicability, relating to or affecting

creditors’ rights generally.

5.3. Capitalization.

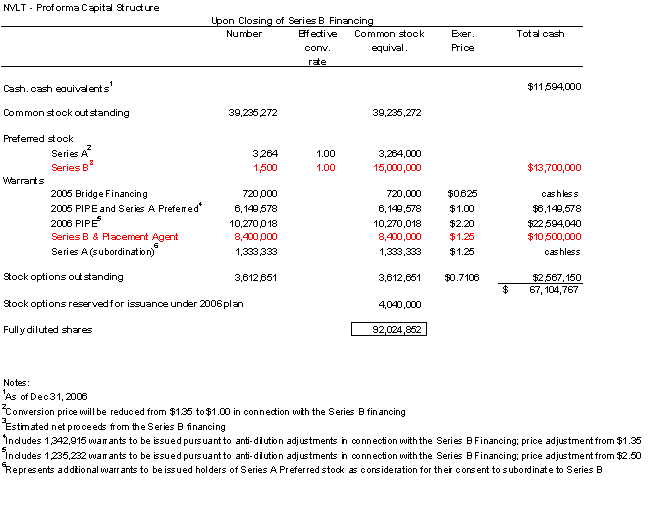

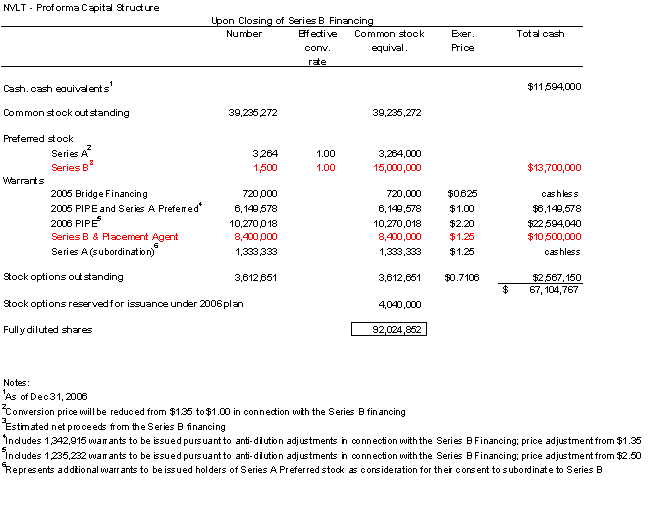

(a) Schedule

5.3

sets

forth (i) the authorized capital stock of the Company on the date hereof, (ii)

the number of shares of capital stock issued and outstanding, (iii) the number

of shares of capital stock issuable pursuant to the Company’s stock plans, and

(iv) the number of shares of capital stock issuable and reserved for issuance

pursuant to securities (other than the Securities) exercisable for, or

convertible into or exchangeable for any shares of capital stock of the Company.

All of the issued and outstanding shares of the Company’s capital stock have

been duly authorized and validly issued and are fully paid, nonassessable and

free of pre-emptive rights and were issued in full compliance with applicable

law and any rights of third parties. All of the issued and outstanding shares

of

capital stock of each Subsidiary have been duly authorized and validly issued

and are fully paid, nonassessable and free of pre-emptive rights, were issued

in

full compliance with applicable law and any rights of third parties and are

owned by the Company, beneficially and of record, and, except as described

on

Schedule

5.3,

are

subject to no lien, encumbrance or other adverse claim. No Person is entitled

to

pre-emptive or similar statutory or contractual rights with respect to any

securities of the Company. Except as described on Schedule

5.3,

there

are no outstanding warrants, options, convertible securities or other rights,

agreements or arrangements of any character under which the Company or any

of

its Subsidiaries is or may be obligated to issue any equity securities of any

kind and, except as contemplated by this Agreement, neither the Company nor

any

of its Subsidiaries is currently in negotiations for the issuance of any equity

securities of any kind. Except as described on Schedule

5.3

and

except for the Registration Rights Agreement, there are no voting agreements,

buy-sell agreements, option or right of first purchase agreements or other

agreements of any kind among the Company and any of its security holders

relating to the securities of the Company. Except as described on Schedule

5.3,

the

Company has not granted any Person the right to require the Company to register

any of its securities under the 1933 Act, whether on a demand basis or in

connection with the registration of securities of the Company for its own

account or for the account of any other Person.

(b)

Schedule 5.3

sets

forth a true and complete table setting forth the pro forma capitalization

of

the Company on a fully diluted basis giving effect to (i) the issuance of the

Preferred Stock and the Warrants at the time of the Closing, (ii) any

adjustments in other securities resulting from the issuance of the Preferred

Stock and the Warrants at the time of the Closing, and (iii) the exercise or

conversion of all outstanding securities. Except as described on Schedule

5.3,

the

issuance and sale of the Securities hereunder will not obligate the Company

to

issue shares of Common Stock or other securities to any other Person (other

than

the Investors) and will not result in the adjustment of the exercise,

conversion, exchange or reset price of any outstanding security.

(c) Except

as

set forth on Schedule

5.3,

the

Company does not have outstanding stockholder purchase rights or any similar

arrangement in effect giving any Person the right to purchase any equity

interest in the Company upon the occurrence of certain events.

5.4. Valid

Issuance.

The

Preferred Stock has been duly and validly authorized and when issued to the

Investors in accordance with the terms of this Agreement will be validly issued,

fully paid and nonassessable, shall have the rights, preferences and limitations

set forth in the Certificate of Designations and shall be free and clear of

all

liens, claims, encumbrances and restrictions, except for restrictions on

transfer set forth in the Transaction Documents and the Certificate of

Designations or imposed by applicable securities laws. Upon the due conversion

of the Preferred Stock, the Conversion Shares will be validly issued, fully

paid

and nonassessable, and shall be free and clear of all liens, claims,

encumbrances and restrictions, except for restrictions on transfer set forth

in

the Transaction Documents and the Certificate of Designations or imposed by

applicable securities laws. The Warrants have been duly and validly authorized

and, upon the due exercise of the Warrants, the Warrant Shares will be validly

issued, fully paid and non-assessable, and shall be free and clear of all liens,

claims, encumbrances and restrictions, except for restrictions on transfer

set

forth in the Transaction Documents and the Certificate of Designations or

imposed by applicable securities laws. The Company has reserved a sufficient

number of shares of Common Stock for issuance upon conversion of the Preferred

Stock and exercise of the Warrants.

5.5. Consents.

The

execution, delivery and performance by the Company of the Transaction Documents

and the Certificate of Designations and the offer, issuance and sale of the

Securities require no consent of, action by or in respect of, or filing with,

any Person, governmental body, agency, or official other than those consents

set

forth on Schedule

5.5

and

filings that have been made pursuant to applicable state securities laws and

post-sale filings pursuant to applicable state and federal securities laws

which

the Company undertakes to file within the applicable time periods. The Company

has taken all action necessary to exempt (i) the issuance and sale of the

Securities, (ii) the issuance of the Conversion Shares upon due conversion

of

the Preferred Stock, (iii) the issuance of the Warrant Shares upon due exercise

of the Warrants, and (iv) the other transactions contemplated by the Transaction

Documents from the provisions of any anti-takeover, business combination or

control share law or statute binding on the Company or to which the Company

or

any of its assets and properties may be subject or any provision of the

Company’s Certificate of Incorporation, Bylaws or any stockholder rights

agreement that is or could become applicable to the Investors as a result of

the

transactions contemplated hereby, including without limitation, the issuance

of

the Securities and the ownership, disposition or voting of the Securities by

the

Investors or the exercise of any right granted to the Investors pursuant to

this

Agreement, the Certificate of Designations or the other Transaction

Documents.

5.6. Delivery

of SEC Filings; Business.

Copies

of the Company’s most recent Annual Report on Form 10-KSB for the fiscal year

ended December 31, 2006 (the “10-KSB”),

and

all other reports filed by the Company pursuant to the 1934 Act since the filing

of the 10-KSB and prior to the date hereof (collectively, the “SEC

Filings”)

are

available on EDGAR. The SEC Filings are the only filings required of the Company

pursuant to the 1934 Act for such period. The Company and its Subsidiaries

are

engaged only in the business described in the SEC Filings and the SEC Filings

contain a complete and accurate description in all material respects of the

business of the Company and its Subsidiaries, taken as a whole.

5.7. No

Material Adverse Change.

Except

as contemplated herein, identified and described in the SEC Filings or as

described on Schedule

5.7(a),

since

January 1, 2007, there has not been:

(i) any

change in the consolidated assets, liabilities, financial condition or operating

results of the Company from that reflected in the financial statements included

in the SEC Filings, except for changes in the ordinary course of business which

have not and could not reasonably be expected to have a Material Adverse Effect,

individually or in the aggregate;

(ii) any

declaration or payment of any dividend, or any authorization or payment of

any

distribution, on any of the capital stock of the Company, or any redemption

or

repurchase of any securities of the Company;

(iii) any

material damage, destruction or loss, whether or not covered by insurance to

any

assets or properties of the Company or its Subsidiaries;

(iv) any

waiver, not in the ordinary course of business, by the Company or any Subsidiary

of a material right or of a material debt owed to it;

(v) any

satisfaction or discharge of any lien, claim or encumbrance or payment of any

obligation by the Company or a Subsidiary, except in the ordinary course of

business and which is not material to the assets, properties, financial

condition, operating results, prospects or business of the Company and its

Subsidiaries taken as a whole;

(vi) any

change or amendment to the Company's Certificate of Incorporation or Bylaws,

or

material change to any material contract or arrangement by which the Company

or

any Subsidiary is bound or to which any of their respective assets or properties

is subject;

(vii) any

material labor difficulties or labor union organizing activities with respect

to

employees of the Company or any Subsidiary;

(viii) any

transaction entered into by the Company or a Subsidiary other than in the

ordinary course of business;

(ix) the

loss

of the services of any key employee, or material change in the composition

or

duties of the senior management of the Company or any Subsidiary;

(x) the

loss

or threatened loss of any customer which has had or could reasonably be expected

to have a Material Adverse Effect; or

(xi) any

other

event or condition of any character that has had or could reasonably be expected

to have a Material Adverse Effect.

5.8. SEC

Filings.

(a) At

the

time of filing thereof, the SEC Filings complied as to form in all material

respects with the requirements of the 1934 Act and did not contain any untrue

statement of a material fact or omit to state any material fact necessary in

order to make the statements made therein, in the light of the circumstances

under which they were made, not misleading. The Company is not (with or without

the lapse of time or the giving of notice, or both) in breach or default of

any

Material Contract and, to the Company’s Knowledge, no other party to any

Material Contract is (with or without the lapse of time or the giving of notice,

or both) in breach or default of any Material Contract. Neither the Company

nor

any Subsidiary has received any notice of the intention of any party to

terminate any Material Contract.

(b) Except

as

set forth on Schedule

5.8(b),

the

Company’s Post-Effective Amendment No. 2 to Registration Statement on Form SB-2

(No. 333-133043), filed by the Company pursuant to the 1933 Act and the rules

and regulations thereunder, as of the date such post-effective amendment became

effective, complied as to form in all material respects with the 1933 Act and

did not contain any untrue statement of a material fact or omit to state any

material fact required to be stated therein or necessary in order to make the

statements made therein, in light of the circumstances under which they were

made, not misleading; and each prospectus relating to such post-effective

amendment filed pursuant to Rule 424(b) under the 1933 Act, as of its issue

date

did not contain any untrue statement of a material fact or omit to state any

material fact required to be stated therein or necessary in order to make the

statements made therein, in the light of the circumstances under which they

were

made, not misleading.

5.9. No

Conflict, Breach, Violation or Default.

The

execution, delivery and performance of the Transaction Documents and the

Certificate of Designations by the Company and the issuance and sale of the

Securities will not conflict with or result in a breach or violation of any

of

the terms and provisions of, or constitute a default under (i) the Company’s

Certificate of Incorporation or Bylaws, both as in effect on the date hereof

(true and accurate copies of which have been provided to the Investors before

the date hereof), or (ii)(a) any statute, rule, regulation or order of any

governmental agency or body or any court, domestic or foreign, having

jurisdiction over the Company, any Subsidiary or any of their respective assets

or properties, or (b) except as set forth on Schedule

5.9,

any

agreement or instrument to which the Company or any Subsidiary is a party or

by

which the Company or a Subsidiary is bound or to which any of their respective

assets or properties is subject.

5.10. Tax

Matters.

Each of

the Company and each Subsidiary has timely prepared and filed all tax returns

required to have been filed by the Company or such Subsidiary with all

appropriate governmental agencies and timely paid all taxes shown thereon or

otherwise owed by it. The charges, accruals and reserves on the books of the

Company in respect of taxes for all fiscal periods are adequate in all material

respects, and there are no material unpaid assessments against the Company

or

any Subsidiary nor, to the Company’s Knowledge, any basis for the assessment of

any additional taxes, penalties or interest for any fiscal period or audits

by

any federal, state or local taxing authority except for any assessment which

is

not material to the Company and its Subsidiaries, taken as a whole. All taxes

and other assessments and levies that the Company or any Subsidiary is required

to withhold or to collect for payment have been duly withheld and collected

and

paid to the proper governmental entity or third party when due. There are no

tax

liens or claims pending or, to the Company’s Knowledge, threatened against the

Company or any Subsidiary or any of their respective assets or properties.

Except as described on Schedule

5.10,

there

are no outstanding tax sharing agreements or other such arrangements between

the

Company and any Subsidiary or other corporation or entity. Neither the Company

nor any Subsidiary is presently undergoing any audit by a taxing authority,

or

has waived or extended any statute of limitations at the request of any taxing

authority.

5.11. Title

to Properties.

Except

as disclosed in the SEC Filings or as set forth on Schedule

5.11,

the

Company and each Subsidiary has good and marketable title to all real properties

and all other properties and assets owned by it, in each case free from liens,

encumbrances and defects that would materially affect the value thereof or

materially interfere with the use made or currently planned to be made thereof

by them; and except as disclosed in the SEC Filings, the Company and each

Subsidiary holds any leased real or personal property under valid and

enforceable leases with no exceptions that would materially interfere with

the

use made or currently planned to be made thereof by them.

5.12. Certificates,

Authorities and Permits.

The

Company and each Subsidiary possess adequate certificates, authorities or

permits issued by appropriate governmental agencies or bodies necessary to

conduct the business now operated by it, and neither the Company nor any

Subsidiary has received any notice of proceedings relating to the revocation

or

modification of any such certificate, authority or permit that, if determined

adversely to the Company or such Subsidiary, could reasonably be expected to

have a Material Adverse Effect, individually or in the aggregate.

5.13. No

Labor Disputes.

No

material labor dispute with the employees of the Company or any Subsidiary

exists or, to the Company’s Knowledge, is imminent.

5.14. Intellectual

Property.

(a) All

Intellectual Property of the Company and its Subsidiaries is currently in

compliance with all legal requirements (including timely filings, proofs and

payments of fees) and is valid and enforceable. Except as listed on Schedule

5.14(a),

no

Intellectual Property of the Company or its Subsidiaries which is necessary

for

the conduct of Company’s and each of its Subsidiaries’ respective businesses as

currently conducted or as currently proposed to be conducted has been or is

now

involved in any cancellation, dispute or litigation, and, to the Company’s

Knowledge, no such action is threatened. Except as listed on Schedule

5.14(a),

no

patent of the Company or its Subsidiaries has been or is now involved in any

interference, reissue, re-examination or opposition proceeding.

(b) All

of

the licenses and sublicenses and consent, royalty or other agreements concerning

Intellectual Property which are necessary for the conduct of the Company’s and

each of its Subsidiaries’ respective businesses as currently conducted or as

currently proposed to be conducted to which the Company or any Subsidiary is

a

party or by which any of their assets are bound (other than generally

commercially available, non-custom, off-the-shelf software application programs

having a retail acquisition price of less than $25,000 per license)

(collectively, “License

Agreements”)

are

valid and binding obligations of the Company or its Subsidiaries that are

parties thereto and, to the Company’s Knowledge, the other parties thereto,

enforceable in accordance with their terms, except to the extent that

enforcement thereof may be limited by bankruptcy, insolvency, reorganization,

moratorium, fraudulent conveyance or other similar laws affecting the

enforcement of creditors’ rights generally, and there exists no event or

condition which will result in a material violation or breach of or constitute

(with or without due notice or lapse of time or both) a default by the Company

or any of its Subsidiaries under any such License Agreement.

(c) The

Company and its Subsidiaries own or have the valid right to use all of the

Intellectual Property that is necessary for the conduct of the Company’s and

each of its Subsidiaries’ respective businesses as currently conducted or as

currently proposed to be conducted, free and clear of all liens, encumbrances,

adverse claims or obligations to license all such owned Intellectual Property

and Confidential Information, other than licenses entered into in the ordinary

course of the Company’s and its Subsidiaries’ businesses. The Company and its

Subsidiaries have a valid and enforceable right to use all third party

Intellectual Property and Confidential Information used or held for use in

the

respective businesses of the Company and its Subsidiaries as currently conducted

or as currently proposed to be conducted.

(d) To

the

Company’s Knowledge, the conduct of the Company’s and its Subsidiaries’

businesses as currently conducted and as currently proposed to be conducted

does

not and will not infringe any Intellectual Property rights of any third party

or

any confidentiality obligation owed to a third party. To the Company’s

Knowledge, the Intellectual Property and Confidential Information of the Company

and its Subsidiaries which are necessary for the conduct of Company’s and each

of its Subsidiaries’ respective businesses as currently conducted or as

currently proposed to be conducted are not being infringed by any third party.

Except as set forth on Schedule

5.14(d),

there

is no litigation or order pending or outstanding or, to the Company’s Knowledge,

threatened or imminent, that seeks to limit or challenge or that concerns the

ownership, use, validity or enforceability of any Intellectual Property or

Confidential Information of the Company and its Subsidiaries and the Company’s

and its Subsidiaries’ use of any Intellectual Property or Confidential

Information owned by a third party, and, to the Company’s Knowledge, there is no

valid basis for the same.

(e) The

consummation of the transactions contemplated hereby will not result in the

alteration, loss, impairment of or restriction on the Company’s or any of its

Subsidiaries’ ownership or right to use any of the Intellectual Property or

Confidential Information which is necessary for the conduct of the Company’s and

each of its Subsidiaries’ respective businesses as currently conducted or as

currently proposed to be conducted.

(f) To

the

Company’s Knowledge, all software owned by the Company or any of its

Subsidiaries, and, to the Company’s Knowledge, all software licensed from third

parties by the Company or any of its Subsidiaries, (i) is free from any material

defect, bug, virus, or programming, design or documentation error; (ii) operates

and runs in a reasonable and efficient business manner; and (iii) conforms

in

all material respects to the specifications and purposes thereof.

(g) The

Company and its Subsidiaries have taken reasonable steps to protect the

Company’s and its Subsidiaries’ rights in their Intellectual Property and

Confidential Information. Each employee, consultant and contractor who has

had

access to Confidential Information which is necessary for the conduct of

Company’s and each of its Subsidiaries’ respective businesses as currently

conducted or as currently proposed to be conducted has executed an agreement

to

maintain the confidentiality of such Confidential Information and has executed

appropriate agreements that are substantially consistent with the Company’s

standard forms therefor. To the Company’s Knowledge, there has been no material

disclosure of any of the Company’s or its Subsidiaries’ Confidential Information

to any third party without the Company’s consent.

5.15. Environmental

Matters.

Neither

the Company nor any Subsidiary (i) is in violation of any statute, rule,

regulation, decision or order of any governmental agency or body or any court,

domestic or foreign, relating to the use, disposal or release of hazardous

or

toxic substances or relating to the protection or restoration of the environment

or human exposure to hazardous or toxic substances (collectively, “Environmental

Laws”),

(ii)

owns or operates any real property contaminated with any substance that is

subject to any Environmental Laws, (iii) is liable for any off-site disposal

or

contamination pursuant to any Environmental Laws, and (iv) is subject to any

claim relating to any Environmental Laws; which violation, contamination,

liability or claim has had or could reasonably be expected to have a Material

Adverse Effect, individually or in the aggregate; and there is no pending or,

to

the Company’s Knowledge, threatened investigation that might lead to such a

claim.

5.16. Litigation.

Except

as disclosed in the SEC Filings, there are no pending actions, suits or

proceedings against or affecting the Company, its Subsidiaries or any of its

or

their properties; and to the Company’s Knowledge, no such actions, suits or

proceedings are threatened or contemplated.

5.17. Financial

Statements.

The

financial statements included in each SEC Filing fairly present the consolidated

financial position of the Company as of the dates shown and its consolidated

results of operations and cash flows for the periods shown, and such financial

statements have been prepared in conformity with United States generally

accepted accounting principles applied on a consistent basis. Except as set

forth in the financial statements of the Company included in the SEC Filings

filed prior to the date hereof, neither the Company nor any of its Subsidiaries

has incurred any liabilities, contingent or otherwise, except those which,

individually or in the aggregate, have not had or could not reasonably be

expected to have a Material Adverse Effect.

5.18. Insurance

Coverage.

The

Company and each Subsidiary maintains in full force and effect insurance

coverage and the Company reasonably believes such insurance coverage is

adequate.

5.19. Brokers

and Finders.

Except

for the commission consisting of cash and warrants to be paid (the “Placement

Agent Fee”)

to the

Placement Agent pursuant to the terms of the Placement Agent Agreement as

disclosed in Schedule

5.19

and the

warrants and fees issuable and payable to the holders of the Company’s Series A

8% Cumulative Convertible Preferred Stock as disclosed on Schedule

5.19,

no

Person will have, as a result of the transactions contemplated by this

Agreement, any valid right, interest or claim against or upon the Company,

any

Subsidiary or any Investor for any commission, fee or other compensation

pursuant to any agreement, arrangement or understanding entered into by or

on

behalf of the Company.

5.20. No

Directed Selling Efforts or General Solicitation.

Neither

the Company nor any Affiliate, nor any Person acting on its behalf has conducted

any “general solicitation” or “general advertising” (as those terms are used in

Regulation D) in connection with the offer or sale of any of the

Securities.

5.21. No

Integrated Offering.

Neither

the Company nor any of its Affiliates, nor any Person acting on its or their

behalf has, directly or indirectly, made any offers or sales of any Company

security or solicited any offers to buy any security, under circumstances that

would adversely affect reliance by the Company on Section 4(2) of the 1933

Act

for the exemption from the registration requirements imposed under Section

5 of

the 1933 Act for the transactions contemplated hereby or would require such

registration the 1933 Act.

5.22. Private

Placement.

Subject

to the accuracy of the representations and warranties of the Investors contained

in Section

6

hereof,

the offer and sale of the Securities to the Investors as contemplated hereby

is

exempt from the registration requirements of the 1933 Act.

5.23. Questionable

Payments.

Neither

the Company nor any of its Subsidiaries nor, to the Company’s Knowledge, any of

their respective current or former stockholders, directors, officers, employees,

agents or other Persons acting on behalf of the Company or any Subsidiary,

has

on behalf of the Company or any Subsidiary or in connection with their

respective businesses: (a) used any corporate funds for unlawful contributions,

gifts, entertainment or other unlawful expenses relating to political activity;

(b) made any direct or indirect unlawful payments to any governmental officials

or employees from corporate funds; (c) established or maintained any unlawful

or

unrecorded fund of corporate monies or other assets; (d) made any false or

fictitious entries on the books and records of the Company or any Subsidiary;

or

(e) made any unlawful bribe, rebate, payoff, influence payment, kickback or

other unlawful payment of any nature.

5.24. Transactions

with Affiliates.

Except

as disclosed in SEC Filings made on or prior to the date hereof, none of the

officers or directors of the Company or a Subsidiary and, to the Company’s

Knowledge, none of the employees of the Company is presently a party to any

transaction with the Company or a Subsidiary or to a presently contemplated

transaction (other than for services as employees, officers and directors)

that

would be required to be disclosed pursuant to Item 404 of Regulation S-B

promulgated under the 1933 Act.

5.25. Trading

Compliance.

The

Common Stock is traded on the OTCBB and the Company has taken no action designed

to, or which to the Company’s Knowledge is likely to have the effect of, causing

the Common Stock not to continue to be traded on the OTCBB. No order ceasing

or

suspending trading in any securities of the Company or prohibiting the issuance

and/or sale of the Securities is in effect and no proceedings for such purpose

are pending or threatened.

6. Representations

and Warranties of the Investors.

Each of

the Investors hereby severally, and not jointly, represents and warrants to

the

Company on and as of the Signing Date and on the applicable Closing Date,

knowing and intending that the Company rely thereon, that:

6.1. Authorization.

The

execution, delivery and performance by the Investor of the Transaction Documents

to which such Investor is a party have been duly authorized and will each

constitute the valid and legally binding obligation of the Investor, enforceable

against the Investor in accordance with their respective terms, subject to

bankruptcy, insolvency, fraudulent transfer, reorganization, moratorium and

similar laws of general applicability, relating to or affecting creditors’

rights generally.

6.2. Purchase

Entirely for Own Account.

The

Securities to be received by the Investor hereunder will be acquired for the

Investor’s own account, not as nominee or agent, and not with a view to the

resale or distribution of any part thereof in violation of the 1933 Act, and

the

Investor has no present intention of selling, granting any participation in,

or

otherwise distributing the same in violation of the 1933 Act. The Investor

is

not a registered broker dealer or an entity engaged in the business of being

a

broker dealer.

6.3. Investment

Experience.

The

Investor acknowledges that it can bear the economic risk and complete loss

of

its investment in the Securities and has such knowledge and experience in

financial or business matters that it is capable of evaluating the merits and

risks of the investment contemplated hereby. The Investor has significant

experience in making private investments, similar to the purchase of the

Securities hereunder.

6.4. Disclosure

of Information.

The

Investor has had an opportunity to receive all additional information related

to

the Company requested by it and to ask questions of and receive answers from

the

Company regarding the Company, its business and the terms and conditions of

the

offering of the Securities. The Investor acknowledges receipt of copies of

and

its satisfactory review of the SEC Filings. Neither such inquiries nor any

other

due diligence investigation conducted by the Investor shall modify, amend or

affect the Investor’s right to rely on the Company’s representations and

warranties contained in this Agreement.

6.5. Restricted

Securities.

The

Investor understands that the Securities are characterized as “restricted

securities” under the U.S. federal securities laws inasmuch as they are being

acquired from the Company in a transaction not involving a public offering

and

that under such laws and applicable regulations such securities may be resold

without registration under the 1933 Act only in certain limited

circumstances.

6.6. Legends.

(a) It

is

understood that, except as provided below, certificates evidencing such

Securities may bear the following or any similar legend:

“THE

SECURITIES REPRESENTED HEREBY MAY NOT BE TRANSFERRED UNLESS (I) SUCH SECURITIES

HAVE BEEN REGISTERED FOR SALE PURSUANT TO THE SECURITIES ACT OF 1933, AS

AMENDED, OR (II) THE COMPANY HAS RECEIVED AN OPINION OF COUNSEL SATISFACTORY

TO

IT THAT SUCH TRANSFER MAY LAWFULLY BE MADE WITHOUT REGISTRATION UNDER THE

SECURITIES ACT OF 1933 OR QUALIFICATION UNDER APPLICABLE STATE SECURITIES

LAWS.”

(b) If

required by the authorities of any state in connection with the issuance of

sale

of the Securities, the legend required by such state authority.

(c) From

and

after the earlier of (i) the effectiveness of the registration of the Conversion

Shares and the Warrant Shares for resale pursuant to the Registration Rights

Agreement and (ii) the time when such Securities may be transferred pursuant

to

Rule 144(k) of the 1933 Act, the Company shall, upon an Investor’s written

request, promptly cause certificates evidencing such Securities to be replaced

with certificates which do not bear such restrictive legends. When the Company

is required to cause unlegended certificates to replace previously issued

legended certificates, if unlegended certificates are not delivered to an

Investor within three (3) Business Days of submission by that Investor of

legended certificate(s) to the Company’s transfer agent together with a

representation letter in customary form, the Company shall be liable to the

Investor for liquidated damages equal to 1.5% of the aggregate purchase price

of

the Securities evidenced by such certificate(s) for each 30-day period (or

portion thereof) beyond such three (3) Business Day-period that the unlegended

certificates have not been so delivered.

(d) Each

Investor, severally and not jointly with the other Investors, agrees that the

removal of the restrictive legend from certificates representing Securities

as

set forth in this Section 6.6 is predicated upon the warranty of the Investors

to sell any Securities pursuant to either the registration requirements of

the

Securities Act, including any applicable prospectus delivery requirements,

or an

exemption therefrom.

6.7. Accredited

Investor.

The

Investor is an “accredited investor” as defined in Rule 501(a) of Regulation D,

as amended, under the 1933 Act.

6.8. No

General Solicitation.

The

Investor did not learn of the investment in the Securities as a result of any

“general advertising” or “general solicitation” as those terms are contemplated

in Regulation D, as amended, under the 1933 Act.

6.9. Brokers

and Finders.

No

Person will have, as a result of the transactions contemplated by this

Agreement, any valid right, interest or claim against or upon the Company,

any

Subsidiary or any other Investor for any commission, fee or other compensation

pursuant to any agreement, arrangement or understanding entered into by or

on

behalf of the Investor.

7. Conditions

to Closing.

7.1. Conditions

to the Investors’ Obligations.

The

obligation of the Investors to purchase the Securities at Closing is subject

to

the fulfillment to the Lead Investors’ satisfaction, on or prior to the Closing

Date, of the following conditions, any of which may be waived in writing by

the

Lead Investors:

(a) The

representations and warranties made by the Company in Section

5

hereof

that are qualified as to materiality shall be true and correct in all respects,

and those not so qualified shall be true and correct in all material respects,

at all times prior to and on the Closing Date. The Company shall have performed

in all material respects all obligations herein required to be performed or

observed by it on or prior to the relevant Closing Date;

(b) The

Company shall have obtained in a timely fashion any and all consents, permits,

approvals, registrations and waivers necessary or appropriate for consummation

of the purchase and sale of the Securities then being issued and sold, and

all

of which shall be and remain so long as necessary in full force and

effect;

(c) The

Company shall have executed and delivered a counterpart to the Registration

Rights Agreement to the Investors;

(d) No

judgment, writ, order, injunction, award or decree of or by any court, or judge,

justice or magistrate, including any bankruptcy court or judge, or any order

of

or by any governmental authority, shall have been issued, and no action or

proceeding shall have been instituted by any governmental authority, or

self-regulatory organization enjoining or preventing the consummation of the

transactions contemplated hereby or in the other Transaction

Documents;

(e) The

Company shall have delivered a Certificate, executed on behalf of the Company

by

its Chief Executive Officer or its Chief Financial Officer, dated as of the

Closing Date, certifying to the fulfillment of the conditions specified in

subsections (a), (b), (d) and (h) of this Section

7.1;

(f) The

Company shall have delivered a Certificate, executed on behalf of the Company

by

its Secretary, dated as of the Closing Date, certifying the resolutions adopted

by the Board of Directors of the Company approving the transactions contemplated

by this Agreement and the other Transaction Documents and the issuance and

sale

of the Securities, certifying the current versions of the Certificate of

Incorporation and Bylaws of the Company and certifying as to the signatures

and

authority of persons signing the Transaction Documents and all related documents

on behalf of the Company;

(h) The

Company shall have delivered to the Investors a duly executed exchange

agreement, dated as of the Closing Date, between the Company and the holders

of

the Company’s Series A Preferred Stock, which exchange agreement, together with

the certificate of designations for Series C Preferred Stock attached thereto,

shall be in form and substance reasonably satisfactory to the Lead Investors

and

which shall be in full force and effect;

(i)

The

Investors shall have received the applicable Company Counsel

Opinion;

(j) No

stop

order or suspension of trading shall have been imposed by any Person with

respect to public trading in the Common Stock;

(k) The

Company shall have delivered evidence satisfactory to the Lead Investors of

the

filing of the Certificate of Designations with the Secretary of State of the

State of Delaware; and

(l) The

Escrow Amount shall, as of the Closing, equal or exceed the Investment

Amount.

7.2. Conditions

to Obligations of the Company.

The

Company's obligation to sell and issue the Securities at Closing is subject

to

the fulfillment to the satisfaction by the Company on or prior to the Closing

Date of the following conditions, any of which may be waived in writing by

the

Company:

(a) The

holders of the Company’s Series A Preferred Stock shall have delivered a duly

executed exchange agreement effective as of the Closing Date and the Company

shall have filed a certificate of designations for Series C Preferred Stock

to

effect the exchange pursuant thereto.

(b) The

representations and warranties made by the Investors in Section

6

hereof

shall be true and correct in all material respects when made, and shall be

true

and correct in all material respects on the Closing Date with the same force

and

effect as if they had been made on and as of said date;

(c) The

Investors shall have executed and delivered the Registration Rights Agreement

to

the Company;

(d) Each

of

the Investors shall have delivered to Lead Investor Counsel the “Aggregate

Purchase Price” set forth opposite such Investor’s name on Schedule

I

affixed

hereto; and

(e) No

judgment, writ, order, injunction, award or decree of or by any court, or judge,

justice or magistrate, including any bankruptcy court or judge, or any order

of

or by any governmental authority, shall have been issued, and no action or

proceeding shall have been instituted by any governmental authority, or

self-regulatory organization enjoining or preventing the consummation of the

transactions contemplated hereby or in the other Transaction

Documents.

8. Covenants

and Agreements of the Company.

8.1. Reservation

of Common Stock.

The

Company shall at all times reserve and keep available out of its authorized

but

unissued shares of Common Stock, solely for the purpose of providing for the

conversion of the Preferred Stock and the exercise of the Warrants, such number

of shares of Common Stock as shall from time to time equal 125% (which

percentage shall be decreased to 100% in the event the Company’s shareholders do

no approve an amendment to the Company’s certificate of incorporation to

increase the number of authorized shares of Common Stock to 150,000,000) of

the

number of shares sufficient to permit the conversion of the Preferred Stock

and

the exercise of the Warrants issued pursuant to this Agreement in accordance

with their respective terms, without regard to any exercise limitations

contained therein.

8.2. Amendment

to Charter.

The

Company shall present to its shareholders for approval at its next annual

meeting of shareholders an amendment to its certificate of incorporation to

increase the number of authorized shares of Common Stock to 150,000,000, and

the

Company shall file as soon as practicable thereafter such approval.

8.3. No

Conflicting Agreements.

The

Company will not take any action, enter into any agreement or make any

commitment that would conflict or interfere in any material respect with the